Fuel Growth with Strategic CFO Support

Unlock elite CFO-level strategy without adding headcount. Our part-time CFOs bring enterprise-level insight to companies earning $1–$20M, without the full-time price tag.

Get financial clarity, smart forecasting, and boardroom-ready insights—on demand.

Let’s talk strategy

book your free consult.Over $105M in tax savings generated. Trusted by 100+ founders across SaaS, healthcare, legal, and agency businesses.

Strategic Finance

Get Clarity. Go Beyond Bookkeeping and Basic Tax Prep.

You’ve outgrown basic accounting.

If you’re running a $1M–$20M business, you’ve already proven the offer and the market. But behind the scenes, the numbers still feel reactive. Decisions rely on gut, and profit isn’t keeping up.

That’s where Strategic Finance changes everything. It ties your cash flow, margin, and tax to real decisions—not just reports.

We go beyond bookkeeping and tax prep to:

Forecast cash flow before problems hit

Track KPIs that actually drive margin

Lock in six-figure tax savings with proactive planning

Build models to support growth, pricing, and exit

Analyze and optimize pricing and packaging

Give CFO-level guidance – without hiring a full-time CFO

“We scaled from $0 to $300K MRR—and knew exactly what was driving margin. That’s what Aaron brought as our CFO.”

Taylor Hersom

Eden Data, Chairman

Strategic FINANCE

Who We Work With

We partner with service businesses where complexity, cash flow, and growth pressure collide.

We work best with:

Marketing & Creative Agencies

Scaling fast but buried in headcount, retainers, and unclear margins? We clean up the chaos and build financial systems that grow with you.

Health & Medical Practices

From clinics to cash-based care, we help you control cash flow, manage growth, and structure for long-term value.

Law Firms

High revenue, thin margin, messy trust accounting – we’ve seen it all. We bring clarity to compensation, forecasting, and firm profitability.

Real Estate

Whether you’re managing transactions, commissions, or passive holdings, we help you structure for tax efficiency and long-term planning.

Cybersecurity & SaaS

You’ve got recurring revenue. We make it scalable, trackable, and exit-ready—with clean financials that support 8–10x multiples.

“Working with Bennett Financials fills the gap we had – a team we can rely on, with rapid-fire responses and consistent support."

Daniel Goodrich

CEO & Founder, VirtualCounsel

Strategic Finance Takes You From Growth… to Control.

Get a system you can run with. Here’s what changes when we work together:

You’ll know exactly where your money is going – and what to do about it

You’ll stop losing margin to chaos, taxes, and misaligned decisions

You’ll scale with clarity, not confusion

Tangible Growth

Why We’re Different

112+ founders rated us 4.8+ stars on TrustPilot

$360K: Average client tax savings per year

$105M+ in tax savings since 2024 – and counting

We don’t just clean up. We give you the clarity to lead.

Strategy-first, not compliance-first.

We’re not here to file and forget. We work inside your business to drive results—monthly, not just at year-end.

Clear, actionable strategy from day one.

We dive into your numbers, identify what’s holding you back, and get to work building the financial systems that drive margin, cash flow, and control.

Hands-on, not hands-off

We work directly with your team to track KPIs, manage cash, and guide decisions. Clients stay with us because they finally feel in control – and never go back to guessing.

We’re the last accounting firm you’ll ever need to hire.

About Us

Clarity by Bennett Financials

We built this firm to fix what traditional accounting gets wrong.

Too many growing businesses were stuck with reactive accountants, surface-level advice, and zero strategic support.

So we created a model that delivers what they actually need: hands-on financial strategy, proactive tax planning, and systems built to scale profitably.

Founded by Arron Bennett, our team has helped hundreds of businesses grow margin, cut taxes, and prep for clean exits. We’re here to raise the standard for what financial support should actually look like.

Frequently Asked Questions

What’s actually included in Bennett Financials’ outsourced CFO service?

Full-Service Bookkeeping

- Accurate monthly books

- Categorized transactions, reconciliations, and real-time reporting

- Monthly financial statements are delivered clearly

Tax Planning & Preparation

- Year-round proactive tax strategy (not just filing)

- Custom plans to reduce liability and protect cash

- Complete tax prep and filing no need to chase a separate CPA

CFO-Level Strategy & Oversight

- Monthly CFO meetings to review performance, adjust direction, and tackle key decisions

- Custom KPIs tailored to your business goals

- Financial forecasting, cash flow modeling, and budget vs. actual analysis

- Scenario planning (what happens if you hire, invest, pivot?)

Clarity + Execution

- Strategic input on pricing, hiring, margins, and profitability

- A dedicated team who knows your business inside and out

Who’s a good fit for CFO support?

Service businesses doing $1M–$10M in revenue that want financial clarity, smarter planning, and more margin. If compliance isn’t cutting it, this is the next step.

What Does It Cost — and What Do I Actually Get?

Our outsourced CFO services are tailored to each client, because no two businesses at the $1M to $10M level have the same financial complexity, team structure, or growth goals. That said, most of our clients invest between $3,000 and $6,000 per month for fully integrated strategic finance support.

Here’s what’s typically included:

- Full-service bookkeeping and monthly reconciliations

- Strategic tax planning and tax preparation

- Monthly CFO meetings and real-time decision support

- Custom KPI tracking and reporting dashboards

- Cash flow management, forecasting, and budget versus actuals

- Profitability analysis including pricing, margin, and cost strategy

- Scenario planning and enterprise value development

- A dedicated financial team that knows your business inside and out

We’re not here to hand you spreadsheets. We’re here to give you a financial infrastructure and the strategic guidance to operate like a real CEO.

If your business is earlier-stage or simpler, we’ll scale the scope accordingly. If it’s more complex—multiple entities, large teams, or high growth—we’ll build a custom structure that fits.

How do you work with my existing bookkeeper or CPA?

At Bennett Financials, we offer flexible ways to support your business depending on your current team structure. While we strongly recommend using our in-house bookkeeping, tax preparation, tax planning, and CFO services for full integration and accountability, we understand that some businesses already have relationships in place.

When clients choose to use our full suite of services, we’re able to take full responsibility for deadlines, communication, and strategy execution. This eliminates delays, ensures tight coordination between departments, and allows us to deliver the clearest possible financial guidance.

However, if you have an existing bookkeeper or CPA you would prefer to keep, we can still lead and support your financial function. In these cases, we work directly with your current financial team to ensure tasks are completed on time and data is delivered in a usable format. We oversee their output and translate it into actionable insights for the business owner.

In either setup, we partner closely with you to drive financial clarity, business strategy, and enterprise value. Our goal is to create alignment between the numbers and the decisions you need to make—whether we are managing your team or working alongside them.

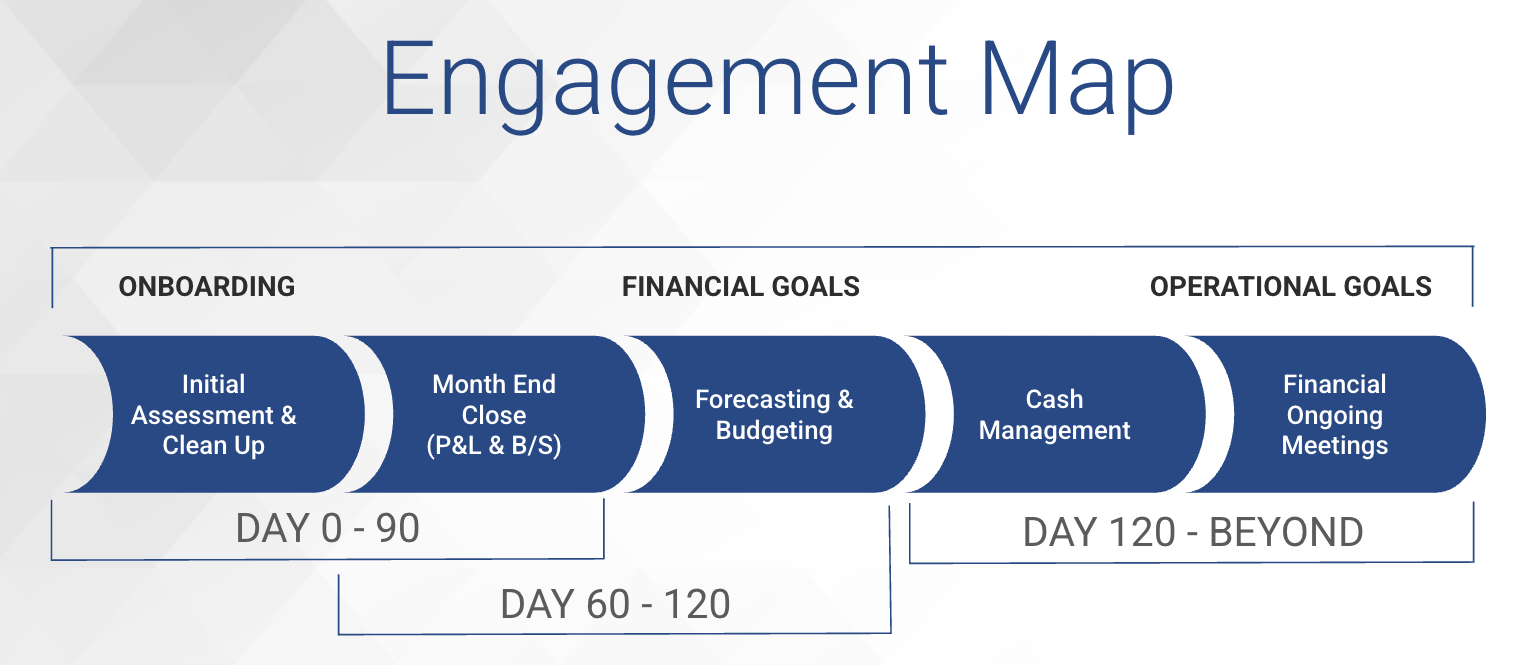

What does our onboarding look like?

Our onboarding process is designed to give business owners clarity, control, and momentum from day one. Rather than jumping into tactical deliverables, we follow a proven phased structure that builds financial infrastructure while setting strategic foundations.

Day 0 – 90: Onboarding Phase

Initial Assessment & Clean-Up

We begin with a deep dive into your financials — identifying gaps, cleaning up your books, and assessing your current systems.

Month-End Close Process

We implement a reliable month-end close rhythm to ensure your P&L and balance sheet are accurate, timely, and actionable. This gives us the first real visibility into how the business is performing.

Day 60 – 120: Financial Goals Phase

Forecasting, Budgeting, and Tax Planning

With clean data in place, we develop forecasts, build your annual budget, and create a proactive tax strategy that aligns with your business goals.

Cash Management & KPI Development

We set up cash flow tracking systems and develop custom KPIs to help you monitor performance and make confident decisions.

Day 120 and Beyond: Operational Excellence

Ongoing Financial Meetings

From here, we operate as your strategic finance team — holding monthly meetings to review financials, adjust strategy, and ensure your business is moving in the right direction.

What does our monthly process look like?

Tax Planning

We begin tax planning in January and continue through December. This ongoing review allows us to identify opportunities, avoid surprises, and adjust strategy in real time.

Client Accounting

Our bookkeeping and accounting team works on your financials each month, ensuring books are up to date and ready for monthly CFO review. This creates accurate visibility into cash flow, profitability, and operational KPIs.

CFO Support

Each month, we review financial performance, model upcoming decisions, and identify bottlenecks. From budget vs. actuals to scenario planning, we help you act on the numbers and move the business forward.

Quarterly Services

Quarterly Estimates

We calculate and file quarterly tax estimates to keep you compliant and ensure there are no surprises at year-end.

Financial Strategy Reviews

Each quarter, we revisit forecasts, review performance trends, and adjust financial strategy based on what’s happening in your business.

Seasonal Services

Tax Season (February to May)

We handle your full tax preparation and filing process, eliminating the back-and-forth with outside CPAs and keeping everything under one roof.

Extension Season (April to October)

If extensions are required, we manage those deadlines internally and ensure filings are completed with plenty of time.

Implementation Period (October to December)

This is when we begin putting next year’s tax strategy into motion. We execute any structural changes, set new goals, and finalize end-of-year decisions.

How long do most clients stay with you?

3–5 years or more. Once they get clarity and control, they don’t want to go back to guesswork.

Case Studies

“He’s more than just a CFO—he brings creative ideas, deep experience, and valuable insights from different industries that have transformed our business.”

Daniel Passarelli

Co-Founder, RHFL

Get the Clarity

You’ve Been Missing

More revenue shouldn’t mean more stress. Let our experienced finance team clean up your financials, protect your margin, and build a system that scales with you.